Energy prices update

Written by Tim Greenhalgh

Posted on January 3, 2018

Oil prices appeared unaffected by continued unrest in OPEC member Iran with high US and Russian output helping deflect pressures.

Price remained steady around mid-2015 highs reached the previous session.

According to Reuters, Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank, warned “multiple but temporary supply disruptions“ like the North Sea Forties and Libyan pipeline outages (and) protests across Iran … helped create a record speculative long bet”.

Hansen advised on the potential for a price downturn in early 2018, with rising U.S. output, pipeline outages resolved and protests in Iran showing no signs of affecting oil production.

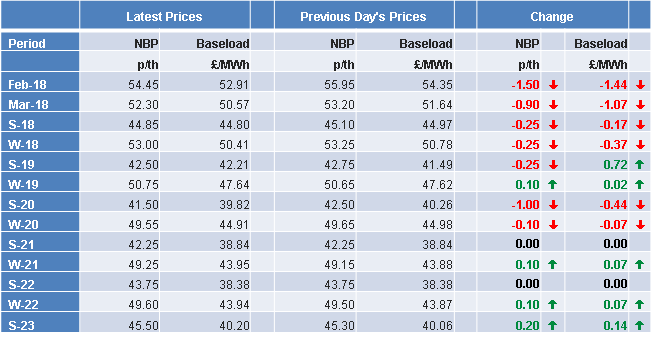

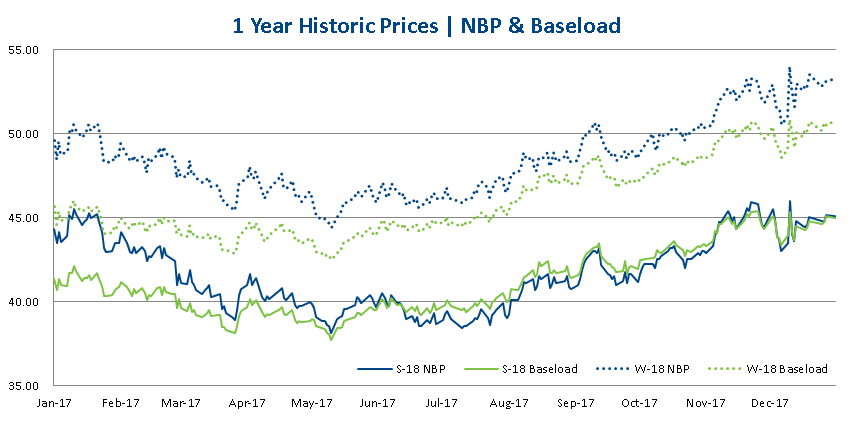

Energy company SSE reports that NBP prices came off later in 2018’s first trading day, after early rises. Lower demand due to warmer temperatures and less requirements from industrial sites, still enjoying a break, helped maintain a long system throughout the day, as did healthy supplies with the Forties Pipeline Network (FPN) now operational again.

The prompt fell over half a penny as a result, while new front month Feb-18 shed over 1.50p/th, with Q218 and S-18 less impacted but still bearish, with marginally lower oil despite coal opening 80¢ higher than it closed the year, and ticking upward a nickel and dime.

SSE also reports that the UK gas system is long again today, although demand is in line with seasonal norms, warmer temperatures for the first week of January seeing demand from non-daily metered sites down.

The UK electricity near curve was pressurised by the weakening NBP market, the day ahead base contract dropped by £2.30/MWh against the previous assessment – but bear in mind the large time delay. New front month Feb-18 shed £1.50/MWh (around 3%) in line with the gas, while some seasons did gain slightly on the back of coal moves

The UK power system looks tight in the peak period as positions are taken, as wind trails off considerably going into Thursday from levels above 7GW intra day; adding over £2.00/MWh to the day ahead base. Unplanned nuclear outages add strain to the system near term, while prices on the near and far curves are pretty much flat against the close.

SaveMoneyCutCarbon can ensure that you are on the very best tariff for your utility supply contract is one service we offer, where material savings can often be delivered at no cost to you. At the very least, it is good to check that your existing supplier is providing the best prices in the everchanging utility market. As part of this mission, we have partnered with Fidelity Energy who provide a market-leading platform for us to access best tariffs on energy and gas supply.

Learn more here: www.savemoneycutcarbon.com/business-utilities